Update: Gov. Jared Polis signed HB 22-1108 into law on Monday, Apr. 18.

By Jeffrey A. Roberts

CFOIC Executive Director

Lawmakers Monday advanced a bipartisan bill that requires Colorado’s online checkbook system to display the names of vendors who do business with the state government.

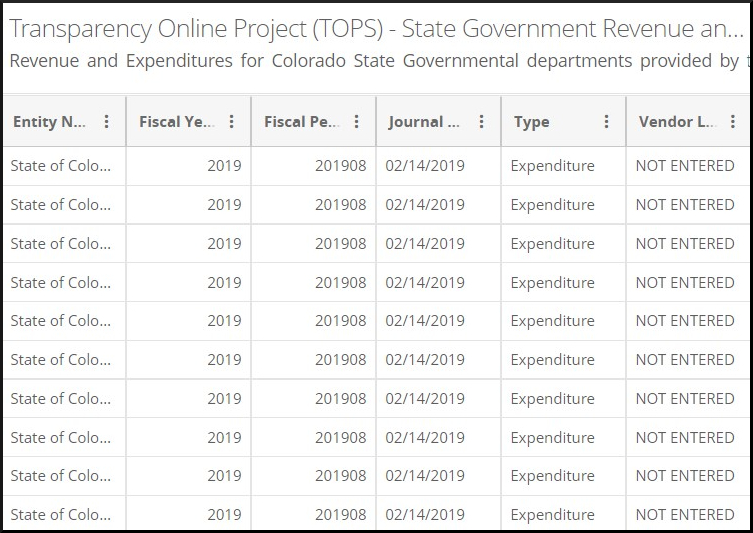

The Transparency Online Project, also known as TOPS, doesn’t always include the names of people and businesses paid to provide services to the state. For instance, a History Colorado payment of $30,000 on Jan. 5 says “NOT ENTERED” in the vendor column. That’s one of many expenditures in the database that don’t identify the payee.

“There is no vendor name. There is no information concerning who was awarded a contract,” said Rep. Janice Rich, the Grand Junction Republican who introduced House Bill 22-1108. “And without that information, the website is largely useless.”

If the state is going to have a website “about transparency that is actually called Transparency Online Project, we should attempt to make that as transparent as possible,” said Rep. Judy Amabile, a Boulder Democrat also sponsoring the bill.

HB 22-1108 passed the House State, Civic, Military and Veterans Affairs Committee and now heads to the House floor. At the request of Gov. Jared Polis’ office, the committee inserted language stating that the web-based system is not required to include a vendor name if a state agency determines that “the public interest is best served” by excluding the name or that including the name is prohibited by law.

“There are some vendors that are confidential,” Rich said. For example, government payments are sometimes made to people whose identities are protected by the federal Health Insurance Portability and Accountability Act (HIPAA), she explained. And some people who are paid witness fees can’t be named.

Follow the Colorado Freedom of Information Coalition on Twitter @CoFOIC. Like CFOIC’s Facebook page. Do you appreciate the information and resources provided by CFOIC? Please consider making a tax-deductible donation.